Sometimes business demands that you engage with the "mundane details." I remember years ago when I was reviewing a deal, I asked the broker for the bank statements. His reaction? "Why? The deal looks fantastic on paper." I responded, grinning, "If I were buying paper, that would be fine. But I'm investing in real estate, so I need those statements."

Needless to say, his reluctance to share the bank statements had a very "valid"(...) reason behind it, and we wisely chose to walk away from the deal.

This experience highlighted a valuable lesson: the mundane and boring details are often the most crucial. When you're evaluating a multifamily real estate investment, it may be tempting to focus solely on the income statement. But what if the bank balance doesn't match up with the income statement? It's essential to consider both bank deposits and accrual income to gain a comprehensive view of the property’s financial health.

Bank deposits offer an immediate glimpse into current cash flows, while accrual income provides a future cash flow estimate. Ignoring the real-time cash movements in the bank can place your investment at risk. A property with strong bank deposits and matching accrual income is likely to be financially stable, capable of meeting mortgage payments and operational costs. Conversely, a property with weak bank deposits but high accrual income may struggle to make ends meet.

So why the emphasis on pouring over bank accounts? Here are some compelling reasons:

-

To assess the property's ability to fulfill its financial commitments.

-

To identify properties that may be heading towards financial instability.

-

To evaluate the amount of debt the property can sustain.

-

To uncover any concealed risks.

-

To negotiate lower interest rates for loans.

-

To secure better acquisition terms.

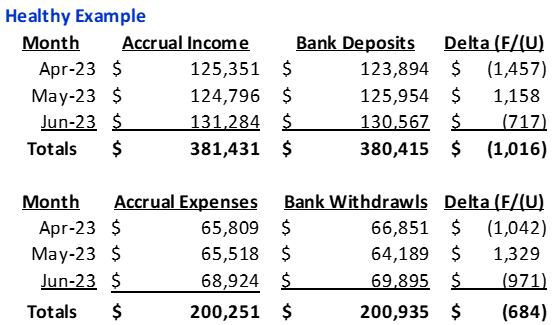

To drive the point home, consider two scenarios. In the first, we see a property with a healthy bank account that doesn't align perfectly with its accrual income. This is usually because accruals and bank transactions occur during different accounting periods.

In the second scenario, we see a financially unstable property with inflated accrual income and understated expenses compared to bank transactions. Ignoring these red flags can make your investment extremely risky.

Such anomalies raise questions about the property’s management and financial accountability. While the reasons for these discrepancies may be elusive, it's clear that something isn't right.

Let's say you bypass checking the bank account and proceed with the purchase. Once you start operating the property, you may realize that the accrual figures were inaccurate, and the real income closely aligns with the bank deposits. This oversight could jeopardize the investment, potentially leading to significant losses, loan defaults, or even bankruptcy.

At Valore, we prioritize the safety of your investment. Our acquisitions and management teams thoroughly vet both bank deposits and accrual income for inconsistencies before closing any deal. If we find anomalies, we conduct a more rigorous forensic analysis to determine the true picture and adjust our valuation accordingly.

In real estate investment, doing your due diligence on these "boring" aspects is non-negotiable. It's the only way to ensure that your hard-earned capital is invested in something that's genuinely REAL. And that's why boring is not just important—it's essential.